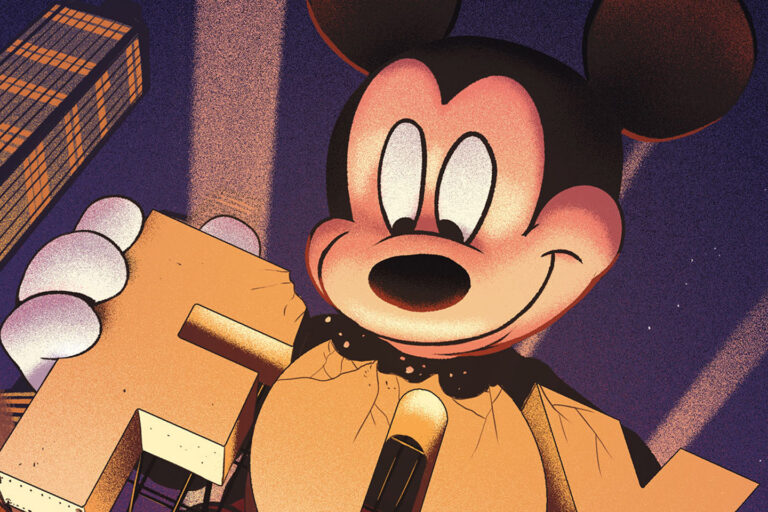

The glittering success of Avatar: The Way of Water at the box office may be hiding the true ramifications of the Hollywood megadeal that brought Disney a $71 billion juggernaut from Fox‘s entertainment empire. As the industry shifts and investors scrutinize spending with a critical eye, it is becoming increasingly clear that Disney’s purchase of Fox may prove to be CEO Bob Iger‘s biggest blunder. Despite the expansive properties and hit movie, Disney still carries a heavy debt from the Fox deal and Iger’s future tenure remains uncertain as he searches for a successor.

With a weakened stock currency and an increasingly skeptical investment community, Iger now faces the challenge of making the most of the company’s existing portfolio. It’s worth noting that had Disney not closed the deal with Fox in 2019, competitor Comcast, whose Peacock streamer is projected to suffer a $3 billion loss in 2023, would have owned 100% of Hulu and Universal and Peacock would have benefited from Fox’s IP riches.

While some argue that Disney kept the Fox assets out of the hands of its rivals, others argue that the overpayment for Fox made sense only when Disney was at the peak of its cultural domination. The plan was for the Fox studios to provide Disney with an edge in adult-skewing blockbusters and kid-friendly fare that could strengthen its position in the streaming war. However, as moviegoers shifted from theaters to streaming, particularly with adult-audience films, Fox’s offerings like The Hate U Give and Dark Phoenix struggled.

Even the kid-friendly IPs like Ice Age proved to be a disappointment, as few Disney+ subscribers watched the related streaming films. Disney’s stewardship of the Fox assets is now under question, with Wall Street raising concerns about the company’s debt and the productivity of its IP portfolio. The closure of Fox 2000 and Blue Sky, and the focus on shutting down former Fox studios rather than nurturing them, has led some to argue that Disney bought Fox only to acquire specific IPs and discarded the rest.

With $45 billion in debt as of September, Disney’s future success will depend on its ability to turn the Fox assets into viable and profitable ventures. For now, only a few brands like Avatar, Planet of the Apes, and the Marvel franchises remain as theatrically viable options for 20th Century.